Understanding the fact- Why Get Phone Insurance for Your Smartphone

When the COVID-19 pandemic situation arrived, many developing companies were caught in the middle of the storm. Also, if we talk individually, many have lost their jobs and due to that, they can’t buy expensive mobile phones, as they are not affordable to them. But there’s an option for you to secure their mobile phone or they can opt to buy a Mi phone as they are very affordable to buy from a low range.

Are you looking to buy a Mi phone or an iPhone or thinking of to gift for your loved ones?

Congratulations! That’s a nice idea. You’ll get a clear-cut idea or guide of how you can protect your phone by getting phone insurance or an extended warranty for your smartphones such as Mi phone insurance or an extended warranty for iPhone.

What are the advantages of mobile phone insurance?

- Replacing a lost phone is easy-

You face a considerable financial loss if your phone is stolen or lost, both of which are quite common occurrences. Those costs would be inconceivable if your phone was an expensive smartphone. Mi phone insurance or extended warranty for iPhone covers this loss and compensates you financially. It allows you to buy another phone without worrying about finances.

- Coverage for repair costs-

Having your phone repaired when you drop it or if liquid enters its internal parts can be quite expensive. The costs can reach tens of thousands, making them unaffordable. Since an extended warranty for iPhone or iPhone insurance covers the repair costs, you don’t have to worry about the financial pinch in case of any damages.

- Is more comprehensive than a warranty-

An extended warranty is offered by mobile phone companies that cover damages to the phone. This warranty is not valid if your phone is lost or stolen. An insurance policy could prove helpful in this case.

Does Phone Insurance cover the prices if the insured loses his or her smartphone or becomes a victim of theft?

Before buying any plan, customers should understand that some phone insurance products might not offer coverage to all or any kinds of damages or loss. Hence, make sure about the product you purchase.

Conclusion-

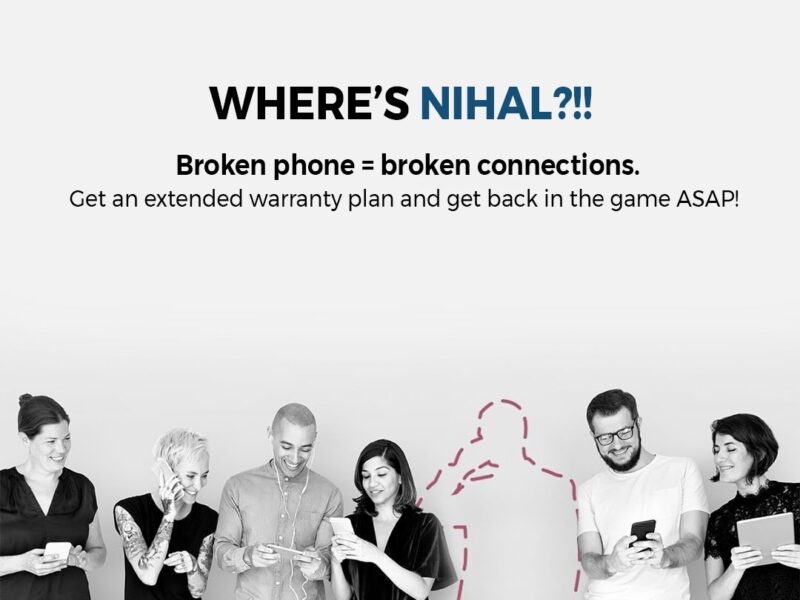

Today, mobile phones have become almost a need for the majority of individuals all over the world. On the other hand, what if you do not go for a mobile insurance plan and your mobile gets lost, stolen, or damaged? Nothing can console you. You’ll lose your peace of mind and suffers monetarily as well as mentally. You have to go to the nearest police station and file an F.I.R.

Eventually, you’ve to buy a new phone and circulate that number among his friends. He has to go ahead and block his phone. But, somehow if this inconvenience can be nullified, then why not go for mobile insurance plans such as Mi phone insurance? Hence, the need of the hour is to compare the mobile insurance deals and choose the appropriate plan that suits your needs and your pocket.

No Comment